Experienced Life Insurance Professionals in Sun Lakes, AZ

Life insurance can be a confusing or overwhelming product that many people don’t want to think about. However, having a life insurance policy is essential for your family’s financial health in case of an unexpected event. No one wants to leave their spouse, children, or business blind sided with unexpected medical bills, burial costs, and concerns about their future. That’s why having a solid life insurance policy should be high on your list of priorities.

If you’re wondering about what types of life insurance policies are available, how much they may cost, and whether they have the value you’re looking for, get in touch with our team of experienced Sun Lakes life insurance agents. We can listen to your needs, guide you through the options, and help you find the coverage you need for peace of mind.

DISCOVER THE BENEFITS OF LIFE INSURANCE

At Phoenix Life Insurance, providing an informative, respectful, and friendly environment is one of our top priorities. Our agents want to help you learn about the various Sun Lakes life insurance policies we provide without putting pressure on you to purchase something you’re uncertain about. When you meet with us, we will take the time to carefully explain all of your options so you can decide what type of life insurance policy might be right for you and your family.

Our trusted Sun Lakes life insurance agency works with nationwide insurance carriers to ensure a variety of options at competitive prices. We work closely with you to determine how much life insurance might be right for you, help you understand the available policies, and how to use life insurance policy to the maximum benefit of your beneficiaries. If you’re ready to learn more about how a life insurance policy can help you, call Phoenix Life Insurance today to get started. We are ready to help!

Types Of Life Insurance Policies Available To Sun Lakes Residents

TERM LIFE INSURANCE

One of the most popular life insurance options is a fixed rate of insurance coverage for a predetermined amount of time. Term life insurance can be a good option for people in specific health categories and age groups.

WHOLE LIFE INSURANCE

Often referred to as traditional life insurance, Sun Lakes whole life insurance is a type of policy that provides a death benefit while also offering a savings component with an accumulative value.

UNIVERSAL INSURANCE

Universal insurance can be an affordable and flexible option for individuals who are seeking alternatives to traditional Sun Lakes life insurance options. Consult with our team to see if this coverage is right for you.

What Advantages Does A Life Insurance Policy Offer?

Tax-Free Income For Your Beneficiaries

A life insurance policy provides a source of tax-free income for your beneficiaries upon your death which can be used to replace your salary, pay off your mortgage and other debts, and provide financial solutions to stabilize and protect your family through a difficult time.

The Cash Value Growth Is Tax-Deferred

The Sun Lakes life insurance policies that we provide offer savings and cash flow value for you and your family. In these cases, you don’t pay taxes on the accumulated savings until you cash out or retire. Consult with one of our experienced Sun Lakes life insurance agents to learn more.

Withdraw Money From Your Policy’s Cash Value

Some types of life insurance policies can double as a savings account with cash value that you can take out when you’re in need. Call us for details on how this smart investment can benefit your family in multiple ways.

Read Our Clients’ Testimonials

Sun Lakes Life Insurance Agency With 5-Star Rated Reviews

BUY LIFE INSURANCE & SECURE YOUR FINANCIAL FUTURE

It’s only natural that you will take on the responsibility of providing for your family and loved ones during your life. However, many people don’t realize that providing for their family is more than just taking a 9-5 job; owning a Sun Lakes life insurance policy is an extremely valuable way to continue to provide financial support for your family when you are no longer with them.

The death benefit of a life insurance policy gives your family money in a bank account that they can access and use after your passing. Although you may have value in a home, investment, or business shares, your family cannot draw from those assets without selling them. They can, however, draw funds from your life insurance proceeds.

The Sun Lakes life insurance agents at Phoenix Life Insurance can help you find the peace of mind and assurance your family needs for the future. We are committed to helping you understand all of the details of your policy and will build a long term relationship of guidance, knowledge, and trust with you.

We Manage The

Best Benefits For You

How Is Your Retirement In In Sun Lakes Looking?

What Happens After You Buy Life Insurance From Phoenix Life Insurance?

At Phoenix Life Insurance, our goal is to help you find the peace of mind you need and confidence in your family’s financial future. A life insurance policy is a valuable investment that continues to provide for your family when you’re no longer able to do so.

Our affordable monthly premium payments ensure that your policy continues to be available to you over time so that you are protected in case of an unexpected event.

Although there are many life insurance options out there, not many people can say that they have the support and care they need from their trusted Sun Lakes life insurance agency. Our team is committed to building long-term relationships with our clients.

If you have any questions about life insurance or are ready to look at the policy options that are available, call Phoenix Life Insurance to speak with one of our dedicated agents. We look forward to serving you.

Tailored Life Insurance Solutions For Your Requirements In Sun Lakes

Partnering With Top Life Insurance Providers In Sun Lakes

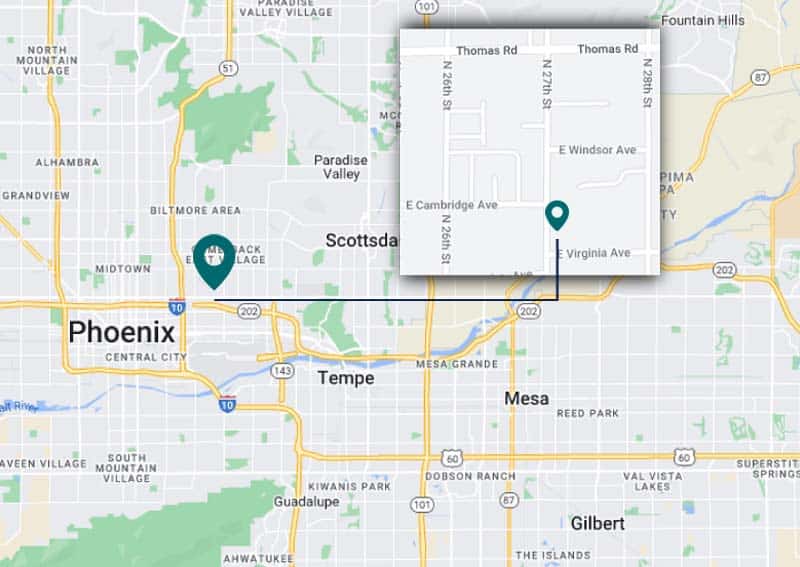

Visit Our Life Insurance Agency Located Near Sun Lakes