The Best Life Insurance Agents In Arrowhead

Life insurance is not typically a top priority for people, but it is an important investment into the future financial security of your loved ones. Having expert guidance as you navigate Arrowhead life insurance policies is a critical piece of finding the right coverage for your needs and your budget. At Phoenix Life Insurance, our agents are experienced and ready to help.

LEARN ABOUT

LIFE INSURANCE

Navigating the complexities of life insurance can be overwhelming and confusing, and you deserve better! As licensed, dedicated Arrowhead life insurance agents, Phoenix Life Insurance is an excellent resource as you seek information regarding the best policy for your needs.

We carry years of experience in the life insurance world, and are committed to providing thorough, honest education so you can make an informed decision.

Types Of Life Insurance Policies Provided For Arrowhead Residents

TERM LIFE INSURANCE

With Term Life Insurance, you will receive coverage for a specific, limited period of time.

WHOLE LIFE INSURANCE

Whole Life Insurance provides coverage for the lifetime of the policyholder.

UNIVERSAL INSURANCE

Experience flexible premium options and other benefits through Universal Life Insurance

What Advantages Does A Life Insurance Policy Offer?

Tax-Free Payouts For Your Beneficiaries

A life insurance policy offers the significant advantage of providing tax-free payouts to your beneficiaries upon your death. The death benefit they receive is typically not subject to income tax, offering a valuable financial resource to help cover immediate expenses and long-term needs. This tax-free nature of life insurance proceeds contributes to the overall financial security and well-being of your loved ones.

Tax-Deferred Cash Value Growth

Another notable benefit of some life insurance policies is the tax-deferred cash value growth. With certain types of permanent life insurance, the cash value within the policy grows over time on a tax-deferred basis, meaning you won’t owe taxes on the growth until you access the funds. This feature provides potential for accumulating wealth within the policy while enjoying tax advantages during the accumulation phase

Accessing Funds From Your Policy’s Cash Value

Finally, life insurance policies with cash value components often allow policyholders to access funds from the accumulated cash value. This feature provides a source of liquidity that can be utilized for various financial needs such as education expenses, emergencies, or supplemental retirement income. The ability to withdraw or take loans against the cash value offers flexibility and serves as a versatile financial resource throughout the policyholder’s lifetime.

When You Are Ready To Buy Life Insurance

Streamlining Your Journey: Tailored Plans, Online Convenience, and Optimal Benefits

Investing in a life insurance policy in Arrowhead is a big step and should not be done without the guidance of a licensed agent. Purchasing a policy independently exposes you to plenty of risks and costs no different than working with an experienced agent. Plus, the lifelong relationship with your agent brings the flexibility to adjust your policy as needed throughout your lifetime.

At Phoenix Life Insurance, Frank Stevens is a top-rated, licensed life insurance agent with a dedication to helping residents of Arrowhead find the best policy for their needs. He is an excellent resource as you ask questions, do research, and invest in a policy for your family.

We Manage The

Best Benefits For You

How Is Your Retirement In Arrowhead?

After You Buy Life Insurance From Phoenix Health & Life Insurance Agency

Life insurance is a financial investment kept secure in a bank account until your death, when it is paid out in a lump sum to your beneficiaries. Life insurance is the only investment that pays out immediately.

At Phoenix Life Insurance, we promise to help you find the best coverage for your needs and budget. Our experienced Arrowhead insurance agents work tirelessly to ensure your policy is paid out quickly to your family so they do not have any financial difficulty following your death.

You will never be pressured to make a quick decision; rather, we provide thorough information in a comfortable setting so you can ask questions and take your time finding the right policy.

Life Insurance For Your Arrowhead Needs

Testimonials

They Already Protect The Ones They Love The Most

Partnerships

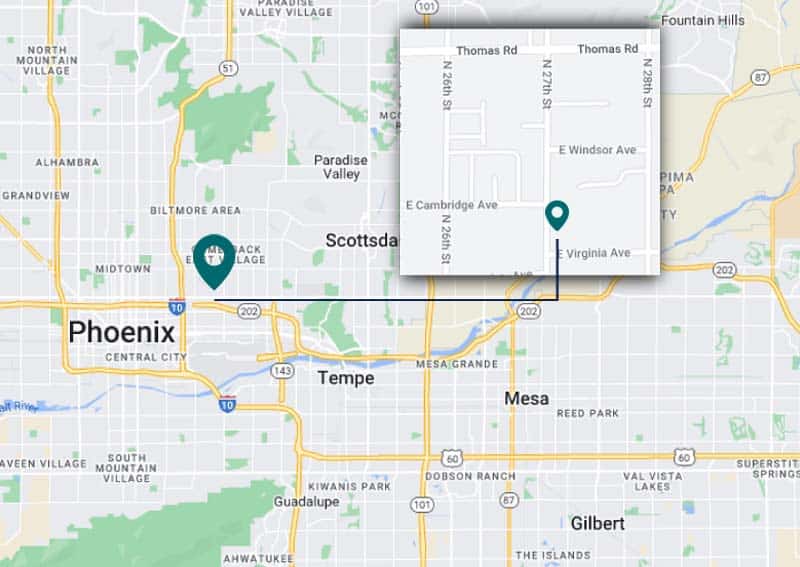

Visit Our Life Insurance Agency Near Arrowhead