Best-Rated Life Insurance Agents In Surprise

Life insurance is a complicated and sometimes confusing product required for a well-rounded financial plan. Nobody wants to leave their children, parents, spouses, or businesses unprepared for the unexpected costs of death. Having the finest life insurance policy for your needs should be a top priority.

If you need assistance from our experienced life insurance agents in Surprise, contact Phoenix Life Insurance. We will guide you in the proper route and discover the coverage you require.

Learn More About

Life Insurance Plans

At Phoenix Life Insurance, our primary goal is to provide an educated and friendly environment in which you can learn about the various products we provide without feeling pressured to purchase something you’re not quite convinced about.

This approach and our unique customer service attention have made us Sunrise’s leading life insurance company. We strive to suit your life insurance needs while educating you on our products so you can choose what works for you.

Types Of Life Insurance Options Available For Surprise Residents

TERM LIFE INSURANCE

Term life insurance offers affordable protection for a defined period. It’s a great choice for those looking to cover short-term needs such as mortgage payments or college tuition. It offers the following benefits:

WHOLE LIFE INSURANCE

As the name implies, it provides lifelong coverage with the added benefit of cash value accumulation. This policy ensures your loved ones are protected no matter what the future holds.

UNIVERSAL INSURANCE

Universal Life Insurance is another incredible option for individuals to consider. While it typically contains flexible premium options, it sometimes requires a single or fixed premium instead. Consult with our qualified team to learn more!

What Advantages Do Life Insurance Policies Provide?

Tax-Free Payouts For Your Beneficiaries

One of the best advantages of life insurance is its tax-free payouts for the beneficiaries. In other words, your loved ones will get the full benefit amount without the burden of taxes, meaning that they will have the financial support they need during difficult times. Besides, our policies provide maximum benefits with minimal hassle.

Tax-Deferred Cash Value Growth

Life insurance policies often come with tax-deferred cash value growth, which is an excellent tool for your policy. It indicates the cash value component of your policy grows over time without being taxed until it is withdrawn. It can be an excellent way to build wealth while protecting your family’s future.

Accessing Funds From Your Policy’s Cash Value

Another benefit is the ability to access funds from your policy’s cash value. This way, you can get a source of emergency funds ready to use when necessary. Feel free to contact our agents to understand how to leverage this feature to your advantage, ensuring you get the most out of your policy.

Purchase Life Insurance Insurance Through Our Agency

Streamlining Your Experience: Tailored Coverage, Digital Accessibility & Optimal Benefits

It is highly advised that you seek the professional advice of a certified agent before attempting to purchase life insurance on your own. While you may think you are saving time and money, this is not true, and the dangers might cost you dearly. Buying from an agent is no more expensive than buying insurance straight from an insurer.

However, the knowledge and understanding you will get about your insurance, as well as the long-term connection you will develop with your agent, are priceless. We want to help you choose the policy and coverage that will fit your current and future needs. Your connection with your Surprise life insurance agent will help us understand your needs and allow us to make the appropriate coverage adjustments.

As a certified life insurance agent in Surprise, Frank Stevens is authorized by the Arizona Department of Insurance to sell a wide range of insurance plans. His extensive expertise and education on the subject make him the ideal candidate to assist you when you need life insurance.

Accessible Life Insurance Options

Offering Multiple Benefits

How Is Your Retirement Shaping Up In Surprise?

After You Buy Life Insurance

Surprise’s Trusted Insurance Agents

While you are living, it is normal to assume responsibility for your family and loved ones. Life insurance is one of several ways you can accomplish this, as it offers financial support for them after you die.

Essentially, this implies leaving money in a bank account for your family to use after you die. While you may have value in other assets, such as equity in your home or shares in an investment or business, your children and spouse cannot access those assets, but they can withdraw from your life insurance policy.

At Phoenix Life Insurance, we strive to provide the peace of mind and certainty that your family requires. We are committed to ensuring that the insurance company processes your claim quickly and carefully so that your spouse does not have to wait and struggle to pay the bills after you have died.

While some people can claim to have life insurance, few can say they have the support and care of a professional life insurance agent who offers them long-term guidance and understanding. Call Phoenix Life Insurance today to talk with one of our devoted, qualified, and certified agents about all of your life insurance requirements!

Life Insurance Tailored to Your Arrowhead Requirements

Our Clients’ Testimonials

5-Star Rated Life Insurance Agents Serving Surprise

Partnerships

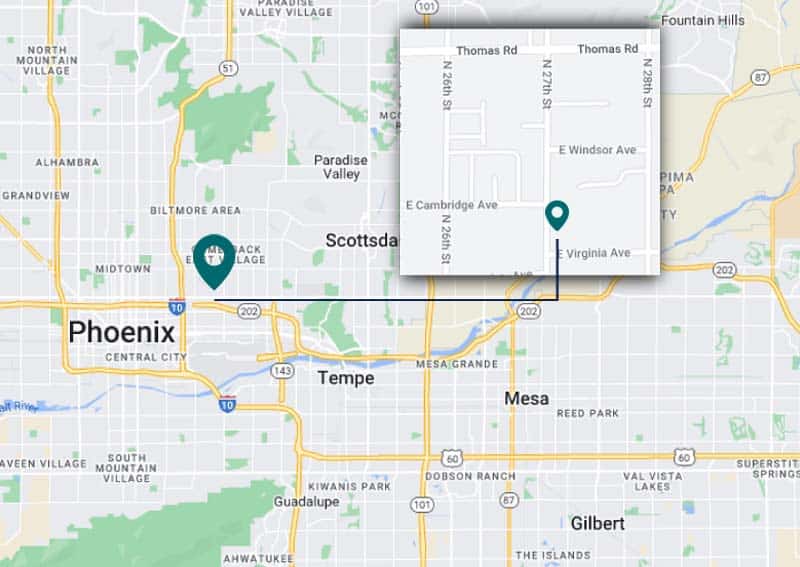

Stop By Our Life Insurance Agency Close To Surprise

2617 N 27th St, Phoenix, AZ 85008