Goodyear’s Leading Life Insurance Agents

Investing in a life insurance policy is an essential piece of a well rounded financial plan. With a life insurance policy in Goodyear, you can ensure the financial security of your loved ones even after your passing. Finding the right policy should be at the top of your priority list, so consult with our five-star agents at Phoenix Life Insurance today!

Learn More About

Life Insurance Plans

When you are ready to invest in a life insurance policy near you in Goodyear, it is best to work directly with a licensed agent rather than attempting to purchase on your own. You may think that you are saving money by purchasing independently, but in reality, the cost is essentially the same as working with an agent. Plus, the lifelong relationship you build will offer a host of benefits.

When you visit Phoenix Life Insurance, you will immediately experience our welcoming, friendly atmosphere where you can feel comfortable to ask all your questions without being pressured to make a decision you are not comfortable making. We take time to review all your options carefully with thorough education, so that you can make an informed choice about what policy will be the best for you.

Types Of Life Insurance Policies Provided For Goodyear Residents

TERM LIFE INSURANCE

Term Life Insurance is a fixed rate insurance policy that offers coverage for a specific period of time. Visit with our Goodyear insurance agents to determine if this is the right policy for you.

WHOLE LIFE INSURANCE

Whole Life Insurance is the most traditional type of life insurance and offers coverage for the lifetime of the insured. It also offers a death benefit and a savings component for accumulated value.

UNIVERSAL INSURANCE

Universal Life Insurance is a policy that offers flexible premium options, but can also require single or fixed premiums depending on the specific policy. Visit with Phoenix Life Insurance for more information.

What Are The Benefits Of Getting A Life Insurance Policy?

Tax-Free Payouts For Your Beneficiaries

A key benefit of having a life insurance policy is the provision of tax-free payouts for your beneficiaries. The death benefit they receive is generally exempt from income tax, ensuring that the full amount is available to support them financially. This tax advantage enhances the value of life insurance as a protective and tax-efficient financial planning tool.

Tax-Deferred Cash Value Growth

With certain types of policies, the cash value component grows over time on a tax-deferred basis, meaning you won’t pay income tax on the accumulated earnings until you withdraw them. This tax advantage allows your cash value to potentially grow more efficiently, contributing to the overall financial flexibility and benefits offered by the life insurance policy.

Accessing Funds From Your Policy’s Cash Value

Policyholders may take loans or make partial withdrawals from the accumulated cash value from certain life insurance policies, providing a source of liquidity for various financial needs. These withdrawals are often tax-free up to the amount paid in premiums, offering a flexible and accessible resource for policyholders during different life stages or financial challenges.

Buy Life Insurance With Our Goodyear Insurance Agency

At Phoenix Life Insurance, our top priority is to provide thorough, reliable information so that you can learn about the policies available to you without the pressure of making a quick decision. Whether you are on the fence or have made the decision to move forward with an investment, our Goodyear health insurance agents are ready to help.

Frank Stevens is a licensed agent approved by the Arizona Department of Insurance to sell a variety of policies. He carries vast experience and knowledge that make him an excellent resource. Call today and schedule a consult with Mr. Stevens!

We Manage The

Best Benefits For You

Looking for Retirement Near Goodyear?

After You Buy Life Insurance From Phoenix Health & Life Insurance Agency

During your lifetime, taking the responsibility of caring for your family and loved ones is natural. With a life insurance policy, you can continue to protect those you love the most after your passing by providing financial support.

Having a life insurance policy essentially means that you are leaving money in a secure bank account that your family can use after your death for funeral expenses, daily bills, and more. While you may have assets in other areas like stocks or business shares, none can be immediately withdrawn except a life insurance policy.

At Phoenix Life Insurance, our agents are dedicated to providing peace of mind by helping you choose the best policy for your needs. We also make sure the insurance company processes your claim quickly so your family does not struggle financially after your death.

With the lifelong support and dedication of a licensed agent, you can trust that your family will be well taken care of after your passing. Your agent can adjust your policy as needed to support your changing needs, and answer questions at any time. Contact Phoenix Life Insurance today to get started!

Life Insurance Plans With Wide Coverage Near Goodyear

Read Our Clients’ Testimonials

Goodyear Life Insurance Agents With Five-Star Reviews

Partnerships

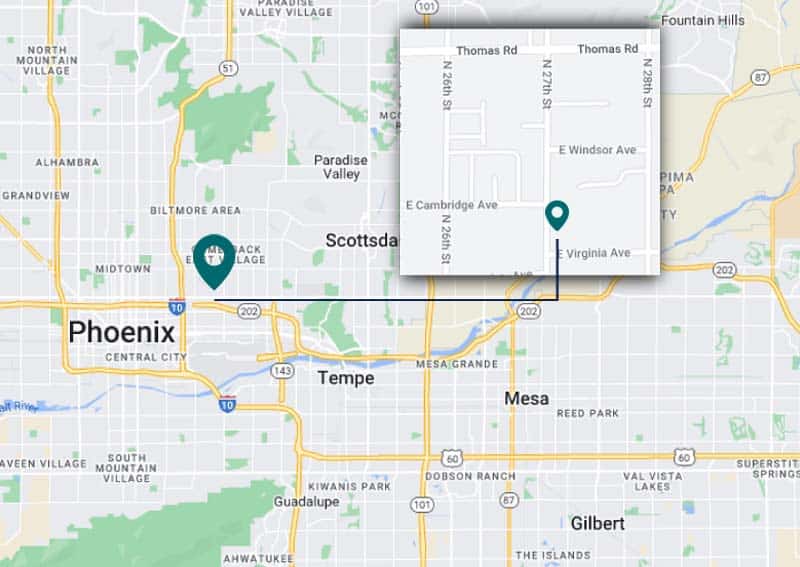

Visit Our Life Insurance Agency Near Goodyear