The Best Life Insurance Agents in Scottsdale

Having a life insurance policy is often completely misunderstood, but is actually one of the best ways you can ensure financial security for your spouse, children, and other loved ones after your death. Life insurance in Scottsdale is affordable, simple, and convenient, providing the peace of mind you deserve.

Our agents at Phoenix Life Insurance can explain the options available so you can make the best choice for your needs and budget, without feeling pressure to make a hasty decision.

Learn About

Life Insurance

Finding a Scottsdale life insurance agency near you that is focused on helping you find the most suitable policy for your needs rather than price gouging you is important. Whether you need to adjust your existing policy or are starting fresh, Phoenix Life Insurance provides comprehensive, honest information.

When you consult with our team, you will never be pressured to make a decision you are not ready to make. Instead, we take time to listen to you, answer your questions, and help you understand what to do next.

Types Of Life Insurance Policies In Scottsdale

Term Life Insurance

Term Life Insurance provides coverage for a temporary, limited period of time, typically used while in between jobs or when facing a risky medical procedure. It is one of the most common types of policies!

WHOLE LIFE INSURANCE

Whole Life Insurance provides lifelong coverage for the policyholder, with fixed, affordable premiums and a valuable cash component for added value. Only your designated beneficiaries receive a payout after your death. Give us a call to learn more!

UNIVERSAL INSURANCE

A Universal Life Insurance policy provides permanent coverage, a death benefit, and a valuable cash component for the policyholder to use during their lifetime. As long as premiums are paid, the Universal policy is active.

Benefits Of Buying A Life Insurance Policy For Families In Scottsdale

Tax-Free Income For Your Beneficiaries

When a policyholder passes away, their beneficiaries receive a financial payout to ease financial strain. The payout is considered net income and is not required to be reported on taxes. However, any interest accumulated on the payout is taxable and must be reported.

The Cash Value Growth Is Tax-Deferred

After investing in life insurance in Scottsdale, any accumulated cash value is not taxed by the government. Ultimately, this allows the value to increase more quickly with greater accumulated interest as well, because it is not losing a portion each year to taxes.

Withdraw Money From Your Policy’s Cash Value

Most life insurance policies provide the option to withdraw money from the policy’s cash value throughout the duration of the policy, without being taxed. Remember that you cannot withdraw or borrow more than the amount you have paid in premiums to date.

TESTIMONIALS

5-Star Rated Reviews Of Clients Protecting Their Loved Ones

WHEN YOU’RE READY TO BUY LIFE INSURANCE

One of the biggest mistakes people make when purchasing life insurance in Scottsdale is attempting to do so independently of a licensed agent, thinking it will save them money. In reality, purchasing an independent policy opens them up to a variety of risks with none of the benefits gained by working with a reputable life insurance agent. The cost is virtually the same, and the expert guidance offered by an agent is priceless.

Frank Stevens is a licensed Scottsdale life insurance agent at Phoenix Life Insurance, with the expertise and qualifications to sell a variety of policies to individuals and businesses. He is honest, straightforward, and trustworthy, with the ability to guide clients through the process of choosing a policy, submitting an application, and moving forward.

Don’t attempt to choose a life insurance policy on your own! Take advantage of Frank Stevens’ knowledge as you make an important decision for your own peace of mind and the financial security of your loved ones.

We Manage The

Best Benefits For You

HOW IS YOUR RETIREMENT LOOKING?

What Happens After You Buy Life Insurance From Our Agents

Many life insurance agencies are more interested in your money than your wellbeing, and put intense pressure on their clients to buy the first policy that they see. Phoenix Life Insurance is different! We don’t simply help you buy a policy and then leave you alone to figure out the rest. Instead, our agents grow and foster a professional relationship with you and your family, so you can feel comfortable reaching out with any questions or getting your policy adjusted as needed.

By investing in a life insurance policy, you are depositing money into a secure bank account to be distributed to your spouse, children, or other designated beneficiaries after your death. Our agents make sure your claim is processed quickly after your death so your loved ones face zero financial struggles.

While many individuals have equity in business shares or real estate, a life insurance policy is the only asset immediately available for use during the transitional period after your death.

Contact Phoenix Life Insurance today to get started! Our Scottsdale life insurance agents are with you every step of the way.

Life Insurance For Your Every Need

We Work With Scottsdale’s Leading Life Insurance Carriers

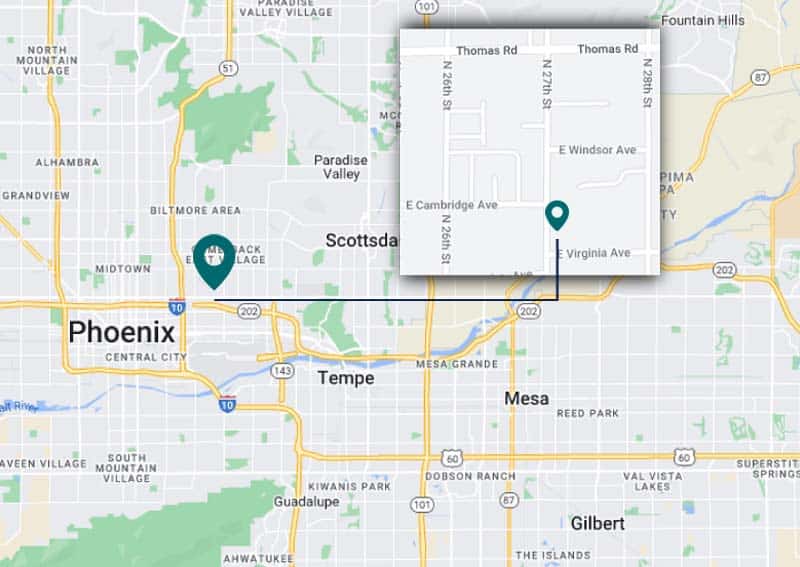

Visit Our Local Life Insurance Agency Near Scottsdale, AZ

Our Life Insurance Agents Offer Services For Clients From All Around Scottsdale

Worried About The Financial Future Of Your Family In Ancala? We’re Here For You!

Need Help Finding The Right Life Insurance Plan In DC Ranch? Give Us A Call!

Searching For A Life Insurance Policy That Fits Your Needs Near Gainey Ranch? Reach Out!

Looking For A Life Insurance Company Near Troon North? Contact Our Agents Today!