The Best Life Insurance Agents Near Glendale

Investing in a Glendale life insurance policy is a vital part of a well-rounded financial plan. It provides financial security for your family members and loved ones in the event of your death.

Wading through the variety of policies available to you can seem complicated, so let Phoenix Life Insurance do the hard work for you. Our licensed agents are well-versed in each policy, and will help you make an informed decision to ensure the needs of yourself and your family are thoroughly covered.

LEARN ABOUT

LIFE INSURANCE

At Phoenix Life Insurance, our goal is to create a friendly, welcoming environment where you feel comfortable asking all your questions without any pressure to make a commitment. We are here to provide honest, thorough information to help you understand the benefits of each policy type.

As experienced, licensed Glendale life insurance agents, Phoenix Life Insurance is driven by a dedication to your financial success. Visit us today to learn more about finding the right insurance policy for your family.

Types Of Life Insurance Policies Provided For Glendale Residents

TERM LIFE INSURANCE

When you invest in Term Life Insurance, you will have coverage for a specific period of time. Consult with our licensed agents to learn more!

WHOLE LIFE INSURANCE

Also known as traditional life insurance, a Whole Life Insurance policy provides coverage for your entire lifetime, and offers a valuable savings component as well.

UNIVERSAL INSURANCE

If you are looking for a policy offering flexible premium options with a savings component and higher value, Universal Life Insurance may be ideal.

Why Buy A Life Insurance Policy In Glendale?

Tax-Free Income For Your Beneficiaries

The death benefit paid out to beneficiaries after the policyholder dies is considered net income and not required to be reported on taxes. Any interest accumulated on the payout is taxable and must be reported.

The Cash Value Growth Is Tax-Deferred

When investing in life insurance in Glendale, any accumulated cash value is not taxed, ultimately allowing the value to increase more quickly with greater accumulated interest because it is not losing a large portion each year to taxes.

Withdraw Money From Your Policy’s Cash Value

The policyholder has the opportunity to withdraw money from the policy’s accumulated cash value anytime during the duration of the policy, without facing tax consequences. Remember that you cannot borrow more than has been paid in premiums to date.

TESTIMONIALS

They Already Protect The Ones They Love The Most

WHEN YOU’RE READY TO BUY LIFE INSURANCE

While you have spent hours researching for yourself and feel ready to purchase a life insurance policy independently, experts strongly advise against it. Purchasing on your own opens you up to a world of financial risks, and the price paid is actually the same whether you purchase through an agent or independently.

Not only do you receive more thorough education and better coverage when you purchase with an agent, you will also experience the benefits of a lifelong professional relationship. We ensure your policy changes to reflect your needs throughout your lifetime, and are always available to answer your questions. Your financial success is our goal, and we do what we can to help.

Frank Stevens is an exceptional Glendale life insurance agent who is experienced in all types of policies. He carries valuable knowledge and expertise that allow him to offer through guidance as you navigate the world of insurance.

We Manage The

Best Benefits For You

HOW IS YOUR RETIREMENT LOOKING?

After You Buy Life Insurance From Phoenix Health And Life Insurance Agency

Caring for your loved ones is a natural part of life, and it is normal to want that care to extend even after your death. Investing in life insurance is an excellent way to ensure your family will be financially secure without you there.

Essentially, having a life insurance policy means that you are placing money in a secure account that will be distributed to your family upon your death. Many people think they have enough equity in stocks, business, or a home, but unfortunately, these methods cannot be accessed immediately. Your family will need immediate payout from life insurance to cover their daily bills and your funeral expenses.

Phoenix Health & Life Insurance is an excellent resource for all your life insurance needs. Whether you are starting from square one or need to reshape your current policy, our licensed agents are qualified and ready to provide professional guidance.

Give us a call today to get started!

Life Insurance For Your Needs

We Work With Glendale’s Top-Rated Life Insurance Carriers

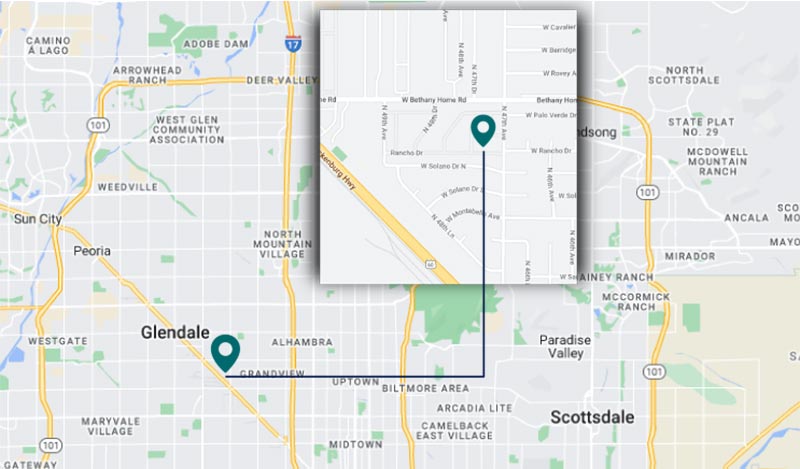

Visit Our Life Insurance Agency Near Glendale

Glendale Neighborhoods Served By Our Life Insurance Agents

Interested In Buying A Whole Life Insurance Policy In Arrowhead Lakes? Get In Touch With Us!

Need Help Finding The Right Life Insurance Plan In Hidden Manor? Call Us Today!

Looking For A Life Insurance Company Near West Augusta? Contact Our Agents Today!

Searching For A Life Insurance Policy That Fits Your Needs Near Palomino? Give Us A Call!