The Best Life Insurance Agents In Paradise Valley

Life insurance is an essential piece of a well-rounded financial plan. Nobody wants their loved ones to be caught off guard without a way to support themselves, so choosing a life insurance policy in Paradise Valley is one of the wisest decisions you can make for your family.

Wading through the infinite number of plans can be an overwhelming process, so get help from a licensed agent at Phoenix Life & Health Insurance. Our expertise and education will help you make an informed decision about the type of coverage you need.

LEARN ABOUT

LIFE INSURANCE

When you visit Phoenix Life Insurance, you will immediately experience our no-pressure, welcoming atmosphere. Our goal is to help you feel comfortable to ask any question while receiving honest information and assistance with making an informed decision.

Our Paradise Valley life insurance agents are knowledgeable, experienced, and dedicated to your financial success. We are prepared to help you fully understand everything that is entailed in choosing a life insurance policy.

Types Of Life Insurance Policies Provided For Paradise Valley Residents

TERM LIFE INSURANCE

Choosing Term Life Insurance means you will have coverage for a specific, limited period of time. Speak with our agents to learn more about this type of policy.

WHOLE LIFE INSURANCE

Whole Life Insurance is the traditional form of life insurance that provides comprehensive coverage for the entire life of the policyholder. It includes a savings component as well.

UNIVERSAL INSURANCE

Universal Life Insurance offers flexible premium options, including both single and fixed premiums, with the added bonus of a savings component and increased cash value.

What Advantages Come With Acquiring A Life Insurance Policy?

Tax-Free Income For Your Beneficiaries

In the event of your passing, the Paradise Valley life insurance payout provides financial support to your loved ones without subjecting them to income tax. This tax-free nature of life insurance proceeds can be a valuable resource for your beneficiaries, offering financial security during a challenging time, making a life insurance plan beneficial.

The Cash Value Growth Is Tax-Deferred

Another advantage is that the cash value growth is tax-deferred. This means that the investment component of certain life insurance policies can accumulate earnings over time without triggering immediate taxation. The tax deferral allows the cash value to grow more efficiently, potentially increasing the overall value of the policy.

Withdraw Money From Your Policy’s Cash Value

Another notable benefit of a life insurance policy is the ability to withdraw money. Policyholders can access the accumulated cash value during their lifetime, providing a source of funds for various financial needs, such as education expenses or emergencies. It’s important to note that withdrawals are generally tax-free up to the amount paid in premiums.

WHEN YOU’RE READY TO BUY LIFE INSURANCE

While you may feel you have a solid understanding of life insurance policies in Paradise Valley, our agents at Phoenix Life Insurance strongly advise against attempting to purchase a policy on your own. The price tag is the same whether you work with an agent or without, and taking advantage of professional expertise from a licensed agent can save you from the many risks of doing it on your own.

Not only do you receive more education and better coverage when working with a qualified agent, but the lifelong professional relationship provides a wealth of benefits. At Phoenix Life Insurance, our agents work diligently to help you find the best policy and coverage, and can easily adjust your policy as your needs change over the years.

Frank Stevens is a top-rated life insurance agent in Paradise Valley, approved to sell a variety of policies. His knowledge and expertise provide excellent guidance as you navigate the world of life insurance policies.

We Manage The

Best Benefits For You

How Is Your Retirement In Paradise Valley Looking?

After You Buy Life Insurance From Phoenix Health & Life Insurance Agency

Throughout your life, it is only natural to care for the ones you love. A life insurance policy provides an excellent way for that care to continue after your death, and is one of the best decisions you can make for the security and wellbeing of your family.

Having a life insurance policy means that money is stored in a secure account that can be drawn from by your family after your death. While you may carry equity in stocks, business shares, home equity, or other assets, life insurance is the only one that is immediately available to cover monthly bills and funeral expenses.

Phoenix Life Insurance is dedicated to helping you understand the policy options available to you, so that you can make an educated decision. Upon your death, our licensed agents ensure that the claim is immediately processed so that your family does not have to struggle financially for any period of time.

Call Phoenix Life Insurance today to begin a lifelong, supportive relationship with a licensed insurance professional!

Life Insurance For Your Needs

TESTIMONIALS

They Already Protect The Ones They Love The Most

Working Alongside Paradise Valley’s Best Life Insurance Carrier

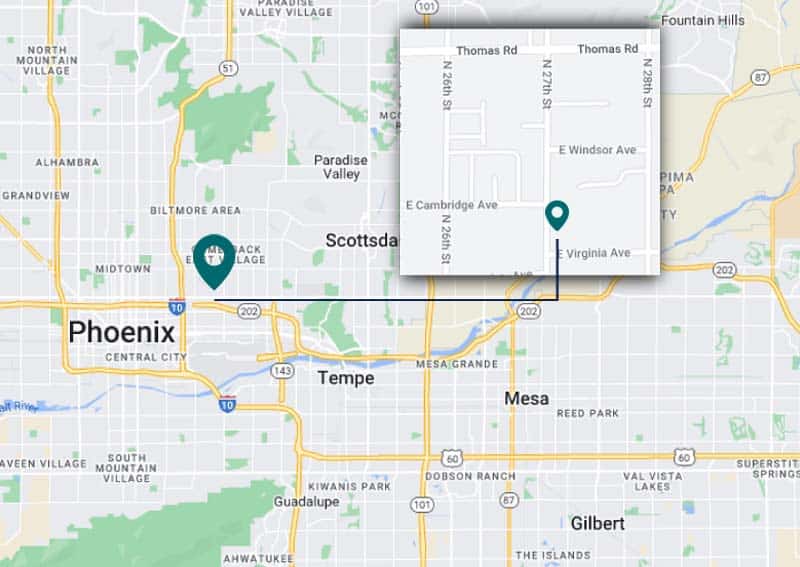

Visit Our Life Insurance Agency Near Paradise Valley