The Best Life Insurance Agents In Queen Creek

Life insurance policies are an excellent way to invest in the future of your loved ones and ensure their financial security after your death. At Phoenix Life Insurance, our Queen Creek life insurance agents can help you navigate through the variety of policies available to find the best coverage for your budget and your needs. Visit our Queen Creek location to learn more!

Learn about Life Insurance

As licensed Queen Creek insurance agents with years of experience in helping clients find coverage, we know that it can be incredibly difficult to understand the features available to you. Our goal is to provide thorough education and reliable information so you can make an informed decision.

You will never be pressured to make a quick decision; we are simply here to help you understand what will work best for you!

Types of Life Insurance Policies Provided For Queen Creek Residents

Term Life Insurance

Term Life Insurance provides coverage for a limited, specific period of time.

Whole Life Insurance

Whole Life Insurance offers coverage for the lifetime of the policyholder.

Universal Insurance

Universal Life Insurance brings flexible premium options and a valuable savings component.

What Are The Benefits Of Obtaining A Life Insurance Policy?

Tax-Free Income For Your Beneficiaries

One of the primary benefits of obtaining a life insurance policy is that it provides tax-free income to your beneficiaries upon your death, ensuring their financial stability during a difficult time. This tax-free payout can help cover funeral expenses, replace lost income, and settle outstanding debts, offering peace of mind and financial security to your loved ones.

The Cash Value Growth Is Tax-Deferred

Another benefit of life insurance is that the cash value component of certain policies can experience tax-deferred growth, allowing you to build up savings over time without immediate tax implications. This tax advantage can be particularly advantageous for long-term financial planning and can potentially provide a source of funds for various needs in the future.

Withdraw Money From Your Policy’s Cash Value

At Phoenix Life Insurance, we encourage life insurance policies for their many benefits including the ability to access the policy’s cash value through withdrawals, loans, or partial surrenders. This can be advantageous for various financial needs, such as covering unexpected expenses, funding education, or supplementing retirement income.

When You’re Ready to Buy Life Insurance

When you have decided to move ahead with your investment into life insurance in Queen Creek, it is best to work with a licensed professional. Purchasing a policy independently opens you up to many different risks, and costs no different than working directly with an insurance agent. You will also experience a lifelong, professional relationship that provides flexibility to change your policy as needed throughout your lifetime.

Frank Stevens is an exceptional insurance agent at Phoenix Health & Life Insurance. With extensive experience and knowledge, Mr. Stevens is an excellent resource for all your questions and concerns as you research different types of life insurance policies.

We Manage The Best Benefits

In Queen Creek For You

How Is Your Retirement

In Queen Creek Looking?

After You Buy Life Insurance From Phoenix Health and Life Insurance Agency

A life insurance policy is a financial investment kept secure in a bank account and paid out in a lump sum to your beneficiaries after you have died. The money can be used to cover funeral expenses or other daily living expenses as your family begins to move forward.

Providing for your family is a natural responsibility, and investing in a Queen Creek life insurance policy is an excellent way to ensure that provision continues after your death. At Phoenix Life Insurance, our agents can modify your policy as needed throughout your lifetime.

We also promise to get your claim processed as quickly as possible so your family does not experience any financial difficulty!

Life Insurance For Your Needs

Testimonials

They Already Protect The Ones They Love The Most

Partnerships

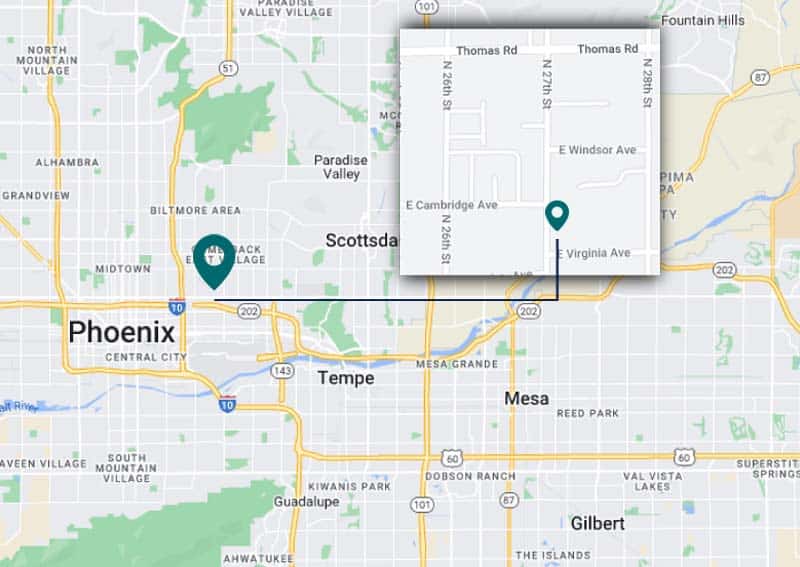

Visit Our Life Insurance Agency Near Queen Creek