The Best Life Insurance Agents In San Tan Valley

Protect your loved ones’ future with our trusted life insurance agents in San Tan Valley. We prioritize exceptional customer service, offering tailored solutions that provide comprehensive coverage and peace of mind. Whether you need term life insurance or whole life insurance, our experienced agents will guide you towards the best options for your budget and family’s financial well-being. Schedule a consultation today.

LEARN ABOUT

LIFE INSURANCE

Life insurance provides financial security and peace of mind for you and your loved ones. It acts as a safety net, ensuring that your family’s future is protected in the event of your passing. Our knowledgeable life insurance agents in San Tan Valley can guide you through the process, helping you understand the different types of policies available and selecting the right coverage that suits your unique needs and goals.

With life insurance, you can create a lasting legacy and provide financial stability for your family. Our dedicated team of agents in San Tan Valley is committed to helping you find the ideal life insurance policy that fits your budget and offers comprehensive coverage. Don’t wait to secure your family’s future – contact us today for a consultation.

Types of Life Insurance Policies Provided For San Tan Valley Residents

TERM LIFE INSURANCE

Term life insurance provides affordable coverage for a specified period. Key features include flexibility, lower premiums, death benefit protection, and simplicity in terms of policy structure.

WHOLE LIFE INSURANCE

Whole life insurance offers lifelong protection with cash value accumulation. Its benefits include lifelong coverage, potential for cash value growth, dividend payments, and the ability to borrow against the policy.

UNIVERSAL INSURANCE

Universal life insurance combines death benefit protection with flexible premium payments and potential cash value growth. Its advantages include flexibility, potential for cash value accumulation, adjustable death benefit, and tax advantages.

What Are The Benefits Of Having A Life Insurance Policy?

Tax-Free Income For Your Beneficiaries

A life insurance policy provides tax-free income for your beneficiaries, ensuring financial security and stability during challenging times. They can receive the death benefit without incurring income taxes.

The Cash Value Growth Is Tax-Deferred

With a life insurance policy, the cash value growth is tax-deferred, meaning you won’t pay taxes on the accumulated cash value until you withdraw or surrender the policy. This tax advantage can help you build savings over time.

Withdraw Money From Your Policy’s Cash Value

Life insurance policies with cash value allow you to access funds by withdrawing from the accumulated cash value. It provides a source of liquidity for emergencies, education expenses, or other financial needs while keeping the policy in force.

TESTIMONIALS

They Already Protect The Ones They Love The Most

WHEN YOU’RE READY TO BUY LIFE INSURANCE

When you’re ready to buy life insurance, it’s important to consider your financial goals, coverage needs, and budget. Assessing your current situation and future plans will help you choose the right policy that provides peace of mind and financial protection for your loved ones.

Start by evaluating the amount of coverage you require based on factors like your income, debts, future expenses, and the needs of your beneficiaries. Research different types of life insurance policies, compare quotes, and seek guidance from a trusted life insurance agent to make an informed decision.

Once you’ve selected a policy, carefully review the terms and conditions, including the premium, policy duration, and any exclusions or limitations. Fill out the application accurately, undergo any necessary medical examinations, and provide the requested documentation. A reliable life insurance agent will guide you through the process and ensure a smooth purchase experience.

We Manage The

Best Benefits For You

How Is Your Retirement In San Tan Valley Looking?

After You Buy Life Insurance From Phoenix Health And Life Insurance Agency

After you buy life insurance from Phoenix Health and Life Insurance Agency, you can rest assured knowing that your loved ones are protected financially. Our comprehensive coverage options provide the security and peace of mind you deserve.

With our experienced team by your side, you’ll receive personalized attention and ongoing support throughout your policy. We’re committed to helping you understand your coverage, make informed decisions, and adjust your plan as needed to meet your changing needs.

In the event of a claim, our dedicated claims department will guide you through the process, ensuring a smooth and efficient experience during a difficult time. Trust us to provide compassionate assistance and handle your claim promptly and professionally.

Choose Phoenix Health and Life Insurance Agency for reliable coverage, exceptional service, and the protection your loved ones deserve. Contact us today to secure your future and safeguard what matters most.

Life Insurance For Your San Tan For Valley Needs

Partnering With Top Life Insurance Providers In San Tan Valley

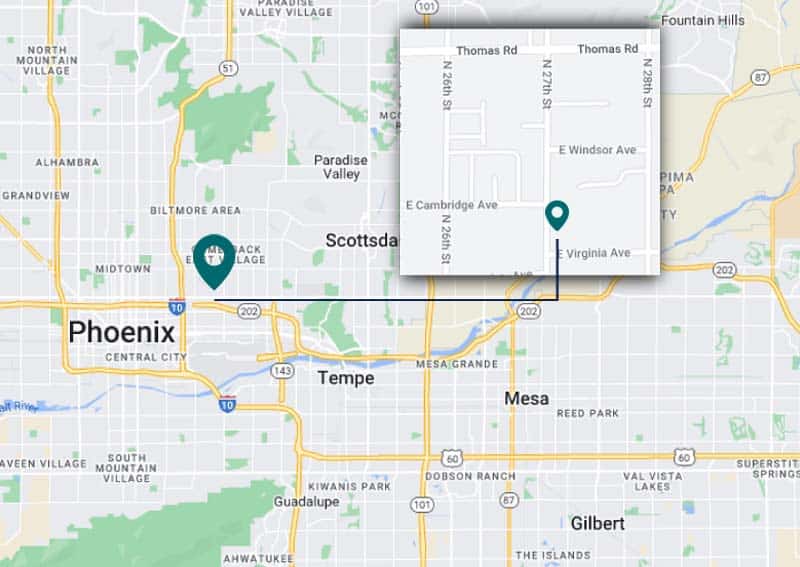

Visit Our Life Insurance Agency Near San Tan Valley

Life Insurance Services Available In Popular Neighborhoods In San Tan Valley

Looking For Reliable Insurance Agents Near Johnson Ranch? Reach Out to Us!

Need Comprehensive Insurance Coverage In San Tan Heights? Give Us a Call!

Searching For Affordable Insurance Plans In Copper Basin? Contact Us Today!

Want To Protect Your Assets In Pecan Creek? Contact Our Agents Today!