Sun City West’s Top-Rated Life Insurance Agency

Life insurance is a vital piece of a well rounded financial plan, but unfortunately is not at the top of the priority list for most. It is misunderstood and often avoided due to common misconceptions. At Phoenix Life Insurance, we understand that life insurance in Sun City West can be complex and confusing, so we are ready to help. As licensed agents, our team explains the benefits and requirements of insurance policies available to you, and help you make an informed decision based on your needs. Schedule a consult with us today!

LEARN ABOUT

LIFE INSURANCE

At Phoenix Life Insurance, our top priority is to provide an informative, friendly atmosphere where individuals can ask questions and learn about various life insurance policies without feeling any pressure to make a decision they are not ready to make.

Our Sun City West life insurance agents take all the time necessary to review the benefits of each option with you and to understand your needs so that we can provide the right education. We are dedicated to providing peace of mind for you and your loved ones!

Life Insurance Agents Serving Sun City West Families

Our Sun City West life insurance agents have years of experience and can guide you through the intricacies of the system and show you the best rates. This way, you can protect your family from hardships.

Types of Life Insurance Policies Provided For Sun City Residents

TERM LIFE INSURANCE

Term Life Insurance provides fixed rate coverage for a specific, limited period of time. Schedule a consult with our licensed team to learn more about Term policies and determine if it is the right option for you and your family.

WHOLE LIFE INSURANCE

Also known as traditional life insurance, Whole Life Insurance provides comprehensive coverage for the lifetime of the insured. The insured can also receive a death benefit and invest in a savings component for added value.

UNIVERSAL INSURANCE

Universal Life Insurance is another incredible option for individuals to consider. While it typically contains flexible premium options, it sometimes requires a single or fixed premium instead. Consult with our qualified team to learn more!

What Benefits Does A Life Insurance Policy Provide?

Tax-Free Payouts For Your Beneficiaries

Life insurance policies offer the significant benefit of tax-free payouts, ensuring that your beneficiaries receive the full amount of the death benefit without the burden of federal income taxes. This key feature provides financial security and peace of mind, knowing that your loved ones will be supported financially in your absence without any tax complications.

Tax-Deferred Cash Value Growth

Many life insurance policies feature a cash value component that grows on a tax-deferred basis. This means that the cash value accumulates over time without being subject to taxes until funds are withdrawn, allowing your investment to grow more efficiently and providing a potential source of tax-advantaged wealth accumulation over the long term.

Accessing Funds From Your Policy’s Cash Value

Policies with a cash value component offer the flexibility to access funds, which can be used for various purposes such as supplementing retirement income, covering unexpected expenses, or funding educational costs. While accessing your policy’s cash value can provide financial flexibility, it’s important to consider the potential impact on the death benefit and policy premiums, ensuring that you use this feature strategically to meet your financial goals.

Buy Life Insurance With Our Life Insurance Agency

Simplifying Your Journey: Customized Plans, Digital Accessibility, & Maximum Advantages

At our life insurance agency, we’re dedicated to simplifying your journey to securing life insurance. Our customized plans are tailored to meet your unique needs, ensuring you receive coverage that aligns with your goals and circumstances. We strive to make the process straightforward and stress-free, with digital accessibility allowing you to manage your policy with ease and convenience, ensuring you’re well-informed and in control every step of the way.

We offer maximum advantages with our policies, ensuring you get the best value and comprehensive benefits. Our team is committed to providing transparent, expert guidance, helping you navigate your options and make informed decisions. With our support, you can secure a life insurance plan that offers peace of mind and financial security, knowing that you and your loved ones are protected. Choose our agency for a personalized, efficient, and rewarding experience in securing your life insurance.

Convenient Life Insurance Plans

With Several Benefits

How Is Your Retirement In Sun City West Looking?

After Buying Life Insurance With Our Agents Sun City West’s Preferred Insurance Agents

After you have invested in a life insurance policy, you will have peace of mind and assurance that your loved ones will be financially secure after your death. Essentially, having a life insurance policy means you are making investments into a secure bank account to be immediately accessible after your death for bills, funeral expenses, and more.

At Phoenix Life Insurance, we take time to learn about you and your family, and walk with you every step of the way for the duration of your policy. We help you find the best coverage to start, and can adjust that coverage to reflect your current and future demands.

After your death, our life insurance agents near you in Sun City West make sure the insurance company processes your claim quickly and thoroughly after your death so that your loved ones do not have to struggle financially. We are licensed, qualified, and experienced, and ready to provide the education you need to make the best personal decision. Call Phoenix Life Insurance today to schedule a consult and learn more about the policies available to you!

5-Star Rated Insurance Agency Near You

Read Our Clients’ Testimonials

Sun City West Life Insurance Agents With Five-Star Reviews

Partnerships

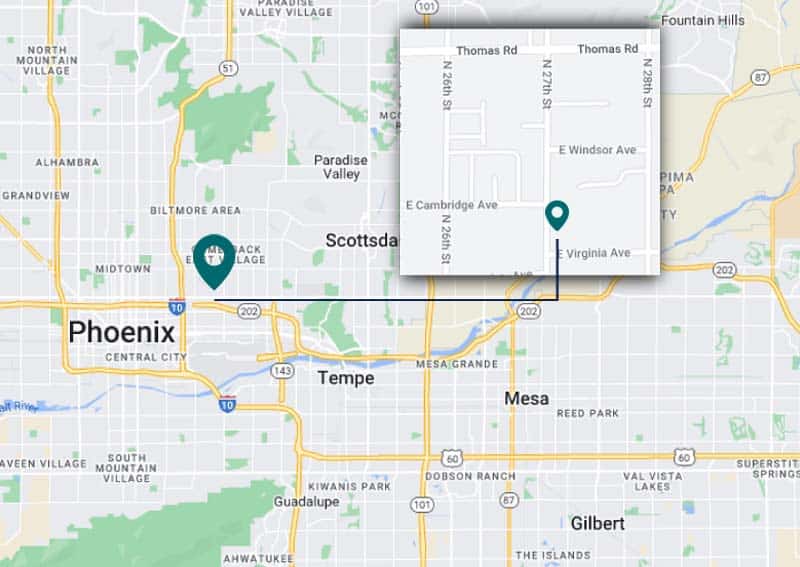

Visit Our Life Insurance Agency Near Sun City West

4738 W Rancho Dr, Glendale, AZ 85301