The Best Life Insurance Agents Near Tempe

Having a well-rounded financial plan is a critical aspect of caring for yourself and your family. Investing in a life insurance policy in Tempe is an excellent way to ensure the wellbeing of your loved ones is covered, even after your death.

Understanding the plans available to you can be confusing, so visit with our licensed agents at Phoenix Health & Life Insurance. We carry valuable experience and knowledge that will help you make an informed decision about the type of coverage you need.

LEARN ABOUT

LIFE INSURANCE

At Phoenix Health & Life Insurance, our goal is to foster a welcoming atmosphere where you feel comfortable to ask all your questions without any pressure in a certain direction. Our Tempe life insurance agents offer honest information and expert guidance as you consider the policies available.

With a dedication to your financial success, our insurance agents are knowledgeable and experienced, prepared to help you understand everything entailed in your decision.

Types Of Life Insurance Policies Provided For Tempe Residents

TERM LIFE INSURANCE

Having Term Life Insurance means that you will have comprehensive coverage for a limited amount of time, at a more affordable starting rate.

WHOLE LIFE INSURANCE

Whole Life Insurance is the most common type of policy, providing coverage for the entire life of the policyholder. There is also a savings component.

UNIVERSAL INSURANCE

Universal Life Insurance provides flexible premiums, including both single and fixed, along with a savings component and higher cash value.

What Are The Advantages Of Purchasing A Life Insurance Policy?

Tax-Free Income For Your Beneficiaries

Life insurance provides tax-free income for beneficiaries because the death benefit paid out to them is typically not considered taxable income under most tax laws. This means that the beneficiaries receive the full amount of your policy’s death benefit without having to pay federal or state income taxes on the proceeds.

The Cash Value Growth Is Tax-Deferred

The growth in the cash value account is not subject to income taxes as long as it remains within the policy. This tax advantage allows policyholders to accumulate funds over time without immediate tax implications, and they can potentially access this cash value through loans or withdrawals without triggering taxable events.

Withdraw Money From Your Policy’s Cash Value

Withdrawing money from your life insurance policy’s cash value allows you to access funds you’ve accumulated within the policy. The benefit is that these withdrawals are often tax-free up to the amount you’ve paid in premiums, providing a source of tax-advantaged income that can be used for various financial needs.

TESTIMONIALS

They Already Protect The Ones They Love The Most

WHEN YOU’RE READY TO BUY LIFE INSURANCE

Many people like to research on their own and try to save money by purchasing a Tempe life insurance policy on their own. However, our agents at Phoenix Health & Life Insurance strongly advise against this decision. Working with a licensed agent protects you from the risks and possible financial loss of going out on your own, and the cost is actually the same whether you purchase with an agent or without.

Along with better coverage and more education regarding your policy when working with a qualified agent, you will experience a lifelong professional relationship that provides many benefits. Our agents at Phoenix Health & Life Insurance work tirelessly to ensure your policy and coverage are the best possible for your family and budget, even as your needs change throughout your lifetime.

Frank Stevens, a top-rated life insurance agent in Tempe, carries valuable knowledge and expertise regarding a variety of policies. Contact Frank today to get started!

We Manage The

Best Benefits For You

HOW IS YOUR RETIREMENT LOOKING?

After You Buy Life Insurance From Phoenix Health And Life Insurance Agency

Caring for your loved ones is a tremendous responsibility as you go throughout life, and it is natural to want that care to extend even after your death. Investing in a life insurance policy is one of the wisest decisions you can make for the financial wellbeing of your family.

Life insurance is simply a sum of money stored in a secure account for your family to access after your death. Though you may feel that equity stored in a business, stocks, or home equity will suffice, life insurance is the only way to provide immediate funds for monthly bills and your funeral expenses.

Our team at Phoenix Health & Life Insurance is committed to helping you understand all the policies available to you, so you can make an educated decision. We ensure your claim is processed quickly after your death so your family does not struggle financially.

Contact Phoenix Life Insurance today to begin a lifelong, supportive relationship with our licensed professionals!

Life Insurance For Your Needs

Working Alongside Tempe’s Best Life Insurance Carrier

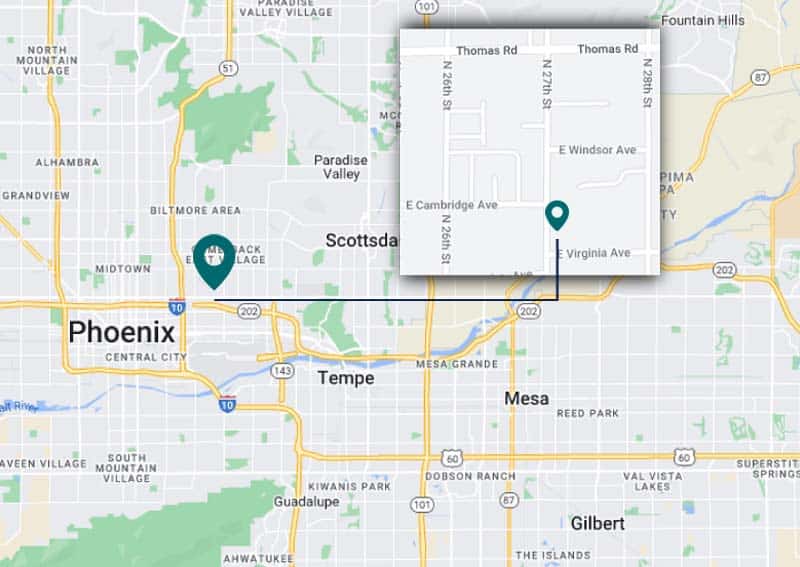

Visit Our Life Insurance Agency Near Tempe

Life Insurance Services Available In Different Tempe Neighborhoods

Want To Secure Your Family’s Financial Future With Whole Life Insurance In Optimist Park? Call Us Today!

Considering Whole Life Insurance Coverage In Hughes Acres? Explore Your Options!

Looking For Comprehensive Life Insurance Plans In Sunset? We’ve Got You Covered!

Need Long-Term Protection For You And Your Loved Ones In Holdeman? Look No Further!